Can I sell my rental property in Florida?

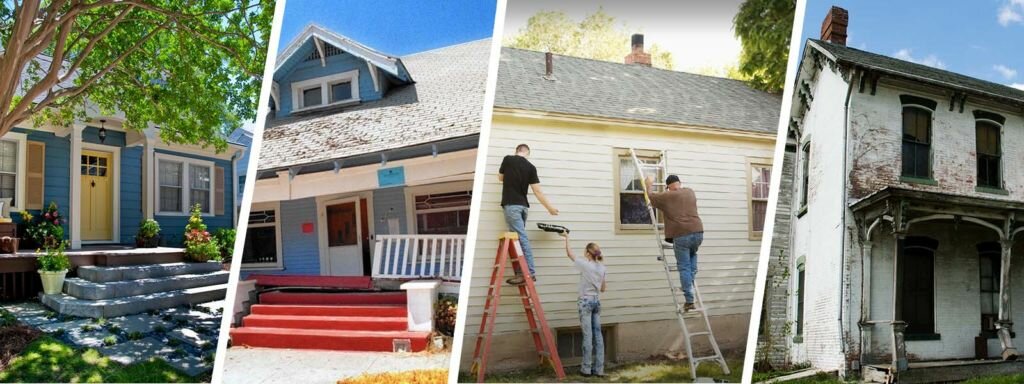

Yes, you can sell your rental property! Being unsure about selling due to tenants, having work that needs to be done on the property, or simply being tired of being a landlord, is all okay, when you are ready it is possible to sell your rental property!

Can I sell my rental property with tenants?

Yes, you can sell a property with a tenant still living in it. Most states laws give tenants the right to remain in a rental property after a sale until the lease or rental agreement expires. Cash investors are a popular group known for buying properties with tenants in place. The lease of the tenants stays in place and just rolls over to the new owner.

How much tax do I pay when you sell my rental property in Florida?

The IRS taxes the profit you made selling your rental property in two different ways: capital gains tax rate of 0%, 15%, or 20% depending on filing status and taxable income. Depreciation recapture tax rate of 25%.

Selling with tenants

Selling with tenants is possible. You can sell with a realtor, For Sale By Owner or you can sell to a cash investor. Cash investors are looking for rental properties to add to their portfolios. They are not as concerned with condition and problematic tenants as if you were selling to the larger community. You can sell your property with tenants that are on fix 1-2 year leases or on month-to-month leases.

Looking for more information on selling your home, click here!