Can an Inherited property be sold?

Yes, you can sell inherited property! If there are multiple heirs, the disparity of opinions on what to do with property could make things difficult to sell. In Florida, you must go through Probate if there isn’t a trust setup or a Survivorship Deed.

What are Florida regulations for selling an inherited home?

If you inherit a home in Florida, you need to go through the Florida Probate Court. Typically, the house cannot be sold until four to six months after you file for probate because you must wait to clear the legal title to the home of the probate proceeding.

Do you need an estate executor?

An Estate Executor performs the plan for assembling assets, communicating with heirs, and honor the will or trust, if one is set up. An in-state executor is important because their primary job is to protect your property until any debts and taxes have been paid, and then transfer what is left to those who are entitled to it. If there is no estate executor then a court will have to find a willing relative to carry out the deceased final wishes. If you must appoint an executor who lives out of state, you should know the requirements Florida imposes on out-of-state executors.

What is the mortgage state of the home?

In many states, the lender retains the title until the mortgage is paid off, while in the other borrower holds the title. In any mortgage state, the lender may begin foreclosure to take over the property if the borrower defaults on his loan.

Do you have to pay Taxes on my inherited property when I sell?

In Florida, you do not pay income tax on any cash received from an estate because the inherited property does not count as income for Federal income tax purposes (and Florida does not have a separate income tax). The State of Florida does not have an income tax for individuals, and therefore, no capital gains tax for individuals. In other states, if you inherit property then sell it, you pay capital gains tax based only on the value of the property starting from the date of death.

What are capital gains?

Capital gains are the profit you earn when you sell an item for more than you bought it. It is classified as either short-term or long-term by the IRS. Short-term capital gains come when you own an asset for one year or less. Long-term capital gains apply when you hold an asset for more than one year.

How do I avoid capital gains tax on inherited property?

To avoid capital gains tax on an inherited property you can sell it right away before market values increases. Option two is to make it a primary residence. A tax exemption is allowed for primary residences and if you live in the home for at least two of the last five years before selling it you may qualify.

Do I have to report the sale of an Inherited property?

If you sell or dispose of inherited property that is a capital asset, you have a long-term gain or loss from property held for more than one year, regardless of how long you held the property.

Does the IRS know when you inherit money?

You do not have to report your inheritance on your state or federal income tax return because an inheritance is not considered taxable income. However, the type of property you inherit might come with some built-in income tax consequences.

What are the sale preparations?

Sales preparations are important because you must consider the many factors such as holding expenses or possible repairs needed. You must discuss the plans with all the heirs to ensure everyone is on the same page before you decide to list the property with an Agent or begin to work with a house buyer. There needs to be a thought-out plan to successfully pull off a sale.

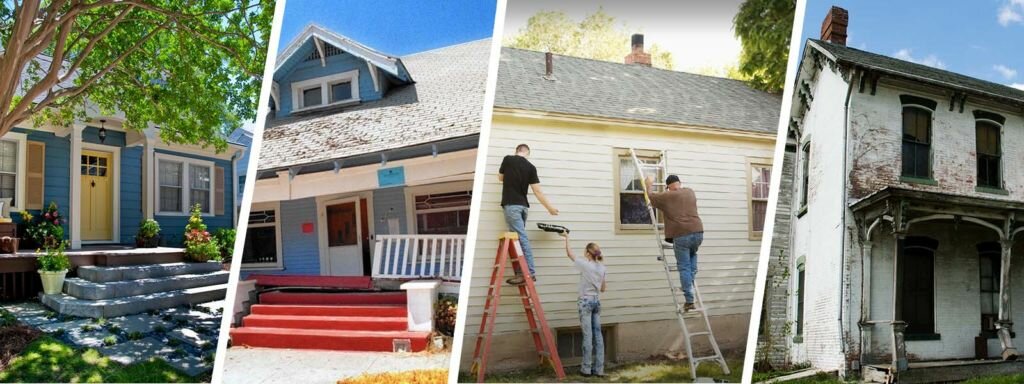

Should the property be sold as-is?

If you do not have the time or funds to repair the inherited house, then you should sell it as-is. Selling the house as-is will help the house to sell fast for cash when working with a house buyer directly, sometimes as soon as seven days.

Clearing out the property?

If you decide to clear out the house to sell, be sure to change the locks in case anyone has a spare key. If you’re working with an expert home buyer, it is not necessary to have the house vacant at closing, we’ll take the house tenant occupied, with trouble tenants, and even with squatters.

For more information: “Click this link”